Even if you don’t stick to it.

People have been saving money. First, it was the uncertainty and layoffs caused by the pandemic and now it’s inflation and increasing cost of living.

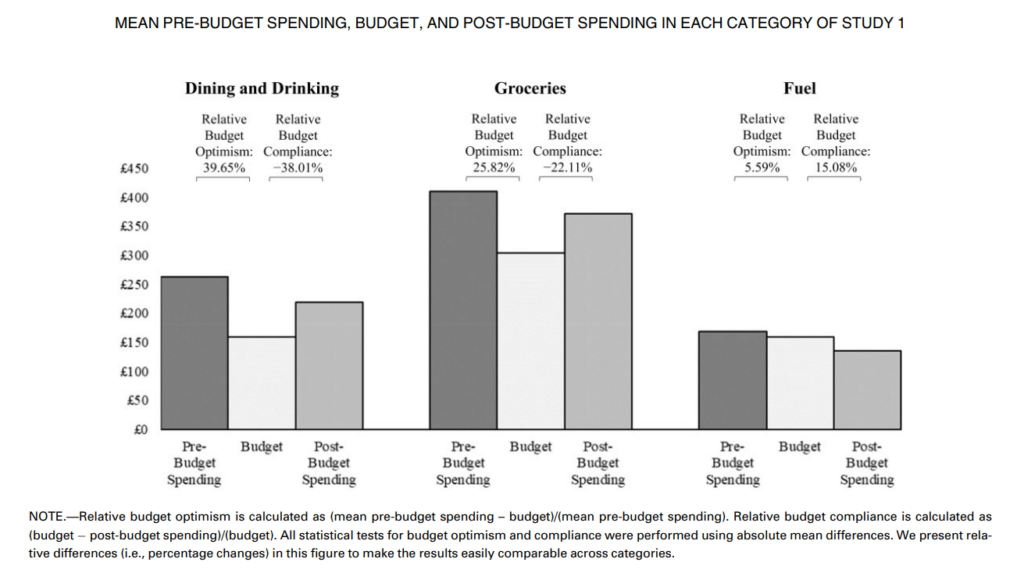

This research about how keeping a budget changes consumer spending is insightful.

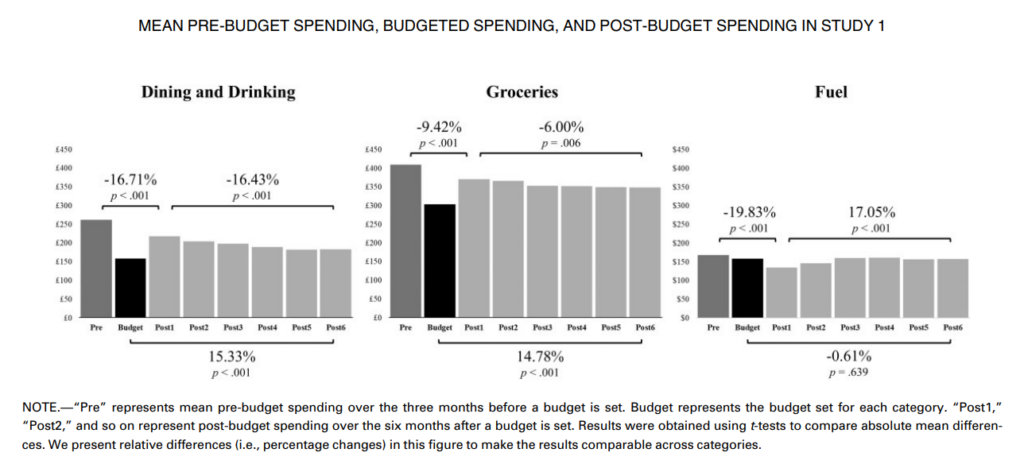

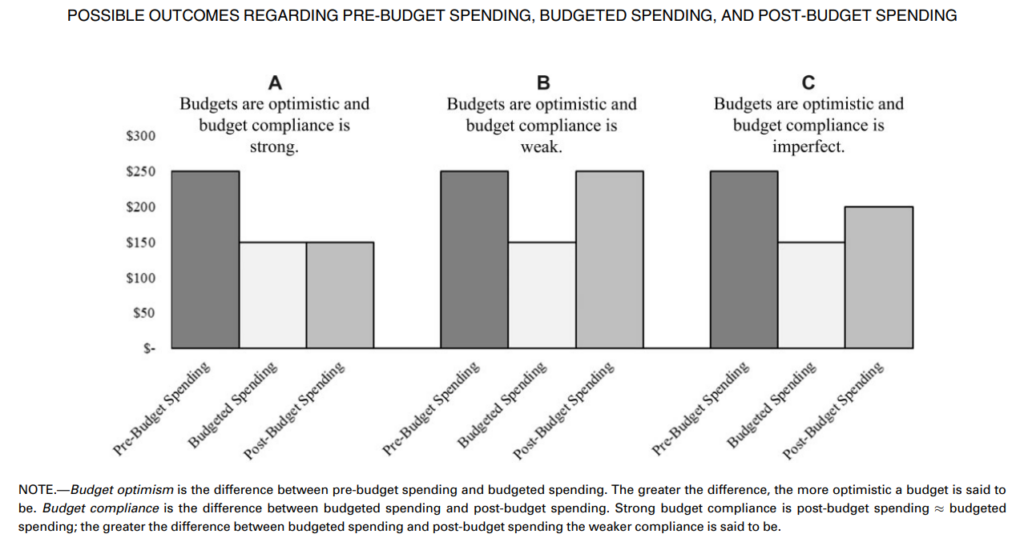

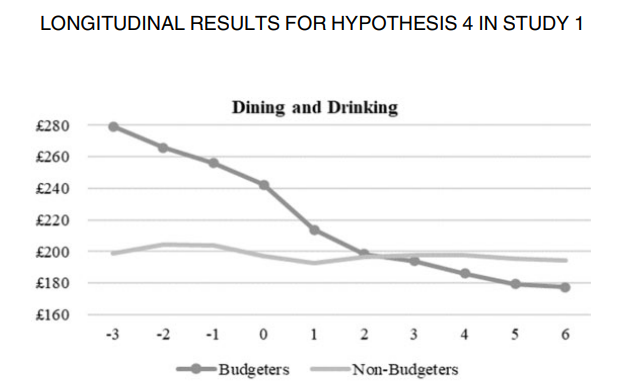

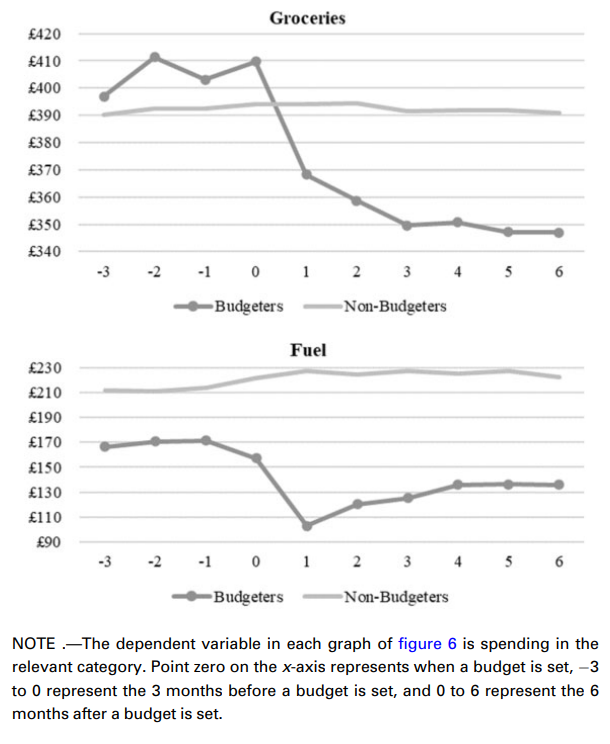

Moreover, the influence of budgets on spending is surprisingly sticky: consumers continue to reduce their spending six months after setting a budget, even though spending remains over-budget. Impulsive consumers exhibit worse budget compliance than less-impulsive consumers. However, counterintuitively, this is predominately because more impulsive consumers set lower budgets than less-impulsive consumers, not because they spend more.

Marcel F Lukas & Ray Charles “Chuck” Howard

Remember these points:

#1. Higher compliance with the budget leads to lower spending in the following months (vs. pre-budget spending) even if you stop following your budget. This is true as long as people keep track of their expenses.

#2. The effect of budgeting is persistent. This is especially true when you’re using an app to actively keep track of your expenses vs. setting a mental budget and when you have a specific budget vs. having category-specific budgets.

#3. Optimistic budgeting has a net positive effect on reducing your spending as long as you keep track of how you’re spending money.

#4. Just the fact that you keep a budget, even if you drop the ball once in a while, has a positive effect on decreasing your expenditure.

#5. How successful people are in saving money (or sticking to their budgets) changes by category. But overall, just the fact that they set a budget decreases how much they spend in that category.

#6. People who are good at curbing impulsive consumption do so by setting optimistic instead of pessimistic budgets.